We are told that because of rising life expectancy the number of pensioners is going up and therefore, to afford pensions, we must cut payments and increase the age of retirement. This conveniently ignores one important detail: the wealth produced by the working class has been growing much faster than the increase in life expectancy. So where does the problem lie?

“Mankind always sets itself only such tasks as it can solve; since, looking at the matter more closely, we will always find that the task itself arises only when the material conditions necessary for its solution already exist or are at least in the process of formation.” Karl Marx, Preface to the Critique of Political Economy

“Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies.” Groucho Marx

The defining characteristics of our epoch are the crushing dominance of the world market, and the decaying system that is world capitalism. The deep crisis the world has been thrust into since 2008 is the living proof of this assertion. The working class all over the world find themselves in the same situation – cuts, unending counter-reforms and attacks on the improvements in conditions won over generations. In this situation, globalisation is turning into its opposite and each nation’s politicians are compelled to justify their attacks by exporting the blame for the crisis: “The crisis is beyond our control; it is not our fault; we have inherited a bad deck of cards…”, etc., etc.

So it is with the pensions crisis – “we are ageing; this is beyond our control, so we must all work longer and tighten the belt in retirement” (as if the belt wasn’t already at the tightest setting for millions.) This tells us next to nothing about the real problem. It attempts to remove responsibility for the attacks from the economic crisis and onto some mystifying, uncontrollable disease known as ‘ageing.’ Why is the fact that more of us are living longer a problem? Surely this should be welcomed?

In a capitalist crisis, profits are squeezed as markets contract and the goods produced remain increasingly unsold. In such a situation the money for pensions, produced by the labour of the masses presently in work, can no longer be paid to those workers in retirement, as the bosses now ‘need’ it to shore up their struggling profit margins. The longer we live, the more we need in pension payments and the less is left for the capitalist class to steal. The money to pay our pensions exists in plenty, the question is, who gets it? The crisis is not ‘natural’ or beyond our control at all. As Marx says, the material conditions necessary for the solution already exist.

The bosses’ media is whipping itself into a frenzy over ‘gold plated public sector pensions.’ They are openly gearing everyone up for massive cuts to public and private sector pension schemes and rights. However, this phrase ‘gold plated’ does not bear comparison with the facts. That is why the only examples ever given are those pensions the top public sector chief-executives get, as if this represents the norm for the millions of public service employees.

The intention of the private media and Tory politicians is to dishonestly divide the working class. It is based purely on encouraging envy. What would the private sector workers, two thirds of whom are in the unenviable position of receiving no employer pension contribution, gain by seeing public sector pension schemes decimated? Although they say otherwise in the media, the strategists of capital look at the working class as a whole and will not stop having cut public sector pensions. A successful dismantling of these schemes would embolden private sector employers to do the same.

Let us analyse the real situation in public sector pensions, which is quite complicated. According to the TUC:

“The mean average public sector pension is £7,000 but the majority of public sector pensioners have pensions of less than £5,000 [per annum]. The value of the main schemes in the public sector for new entrants are similar to a medium private sector final salary, at around 21% to 24% of salary on average [...] The average pension in Local Government is around just £4,000 per year, and just £2,000 for women while in the Civil Service the average is £6,500. The average pension for a female NHS worker is £5,000 but the median pension for women is much less. In fact half of all women pensioners who have worked in the NHS get a pension of less than £3,500 per year.”

Gold-plated indeed! Furthermore, serious cuts have already been made. In his long awaited report, John Hutton revealed that the value of public service pensions has already been effectively cut by 25 per cent, if you take the effects of the 2005 negotiated changes and the switch to CPI indexation into account. (source: Nigel Stanley on the TUC’s Touchstone Blog). Figures given for average pensions, as with income in general, distort reality as small numbers of extremely high earners pull the ‘mean’ average artificially up. This statistical method obscures the most important fact, which is not the overall average in society but the immense inequality in society. We therefore prefer to use median averages, which measures the value that the majority of people get more or less than.

In fact, so undeniable is the poverty many public sector workers will be compelled to live in upon retiring, that even John Hutton’s report (which was set up to find ways for the government to justify cutting public sector pensions) had to admit that: “It is mistaken to talk about ‘gold-plated’ pensions as being the norm across the public sector. In the most part, the pensions that are paid out to public service employees when they retire are fairly modest by any standard”.

Nevertheless, balanced and factually accurate thinking is not exactly a characteristic this government possesses as it wields the axe like never before. This is because massive redistribution of wealth from the working class to the capitalist class cannot be justified openly to the public and yet this is precisely what 21st century capitalism requires. It is clear that public sector workers will be made to significantly increase their contributions to the pension schemes, something private sector workers in what are known as ‘defined contribution’ schemes (more on these later) are already familiar with. This means an immediate wage cut.

Since pensions are actually deferred wages, one would expect an increase in employee contributions to result in a corresponding increase in pension payments upon retirement. Think again. The government has already announced that as of April 2011, pensions in payment will rise with the Consumer Price Index (CPI) rather than the Retail Price Index (RPI) as it has been. The government will try to tell us that the former simply happens to be a more economically sound measure; it also happens to be about 1.3% lower than the latter! Over the years, this means a massive cut to the value of pensions – and, as deferred wages, this means a further wage cut. Indeed, The Economist has callously identified this method as the most effective way to cut pensions: “raising the retirement age by a year would trim the cost [i.e. total wages paid to workers in retirement] by 2-4%; a cut of a percentage point in inflation-linking would slash it by 9-11%”.

These tactics – increased contributions with smaller pension payments, along with raising the retirement age – will form the government’s strategy of attacking our pension rights. The government, representing big business, has chosen CPI because it is in their class interests, not for reasons of economic soundness. We should behave accordingly; we must fight for the use of RPI as a bare minimum, and against increased contributions, because it is in the interests of the working class.

Marxism understands the vital importance of ideology in the maintenance of unjustifiable inequality. We must fight strenuously against the nonsense that an ageing society can no longer afford retirement. First of all we must ask who is ageing? For most workers, life expectancy has only risen by less than two years since the 1970s. Life expectancy for the average female hospital cleaner, for example, has not increased by one day since then. Many people, especially manual workers, are still only predicted to live until the age of 65 – meaning they’re likely to die before they get any pension whatsoever. We hear all the time about the ever widening age differentials between the classes. Life expectancy in Kensington and Chelsea is 10 years greater than that for the whole of Glasgow – the figure would be even greater for Glasgow’s poorest districts. We contest the idea that the working class, who produce the wealth the bosses all live off, is a drain on society, especially when it is only ageing very slowly.

Generally speaking, labour productivity and GDP rise faster than we age - the whole basis of human society consists in our ability to develop and expand what we can produce quicker than population rises, although as capitalism declines it has a good stab at dragging GDP rates down with it! This situation is backed up by numerous facts. The Government’s own documents prove it: "The changing demographic structure of the UK’s population – especially the ageing aspect – is projected to have only a limited impact on public spending over the coming decades". (Fiscal Sustainability and the Ageing Population, page 49).

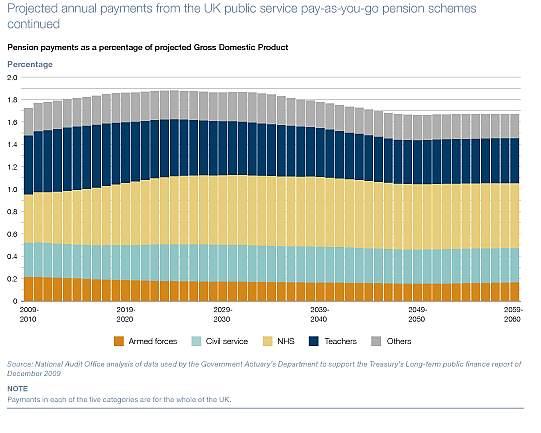

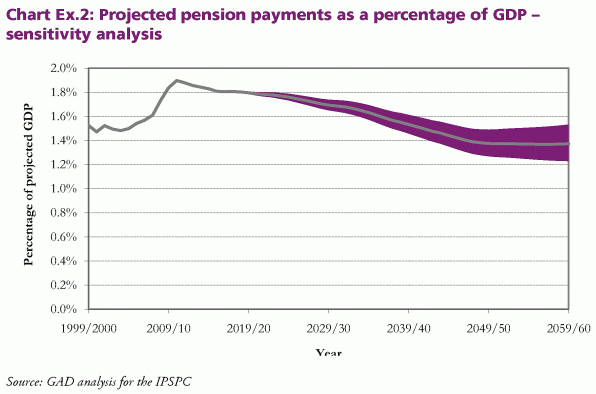

Nigel Stanley has also compiled this useful table, demonstrating the lessening drain of public service pensions in relation to GDP (that is, if capitalism can guarantee that GDP continues to rise!)

% of GDP | 2010 | 2020 | 2030 | 2040 | 2050 |

Public service pensions | 1.8 | 1.9 | 1.9 | 1.8 | 1.7 |

The following charts clearly show that public sector pensions are easily affordable. The data is compiled based on pension plans before the government announced cuts:

Part of the confusion that is created around this question is fostered by the media and politicians deliberately quoting ever increasing pension payments as time goes on and then implying this is due to ‘the ageing society’, forgetting to mention that GDP also rises as time goes on. Mark Weisbrot in The Guardian makes a similar point with regard to the struggle unfolding in France, “France's retirement age was last set in 1983. Since then, GDP per person has increased by 45%. The increase in life expectancy is very small by comparison. The number of workers per retiree declined from 4.4 in 1983 to 3.5 in 2010, but the growth of national income was vastly more than enough to compensate for the demographic changes, including the change in life expectancy.”

The myth of ever fattening public sector pensions is simply not true. “Employee contributions to these schemes have increased faster (56%) than pension payments (38%) since 2000, and there has only been a 2% real terms increase in the average pension in payment since 2000 – the average teachers’ pension has actually fallen by 4% over that period and the NHS average pension is unchanged.” (Nigel Stanley on the TUC’s Touchstone blog)

Another line of attack is likely to be making public sector pensions more like private ones in that they will be forcibly moved from being ‘defined benefit schemes’ (DB) to ‘defined contribution’ (DC). In the former the employer is obliged to pay a set pension related to the employee’s final salary and the risk of funding this adequately is borne by the employer. With the latter, the employee is paid only in accordance with what happens to be in the pot come retirement. The employer has the privilege of managing this vast sum of money but the employee bears the substantial risk that the fund is exposed to on the market. DC schemes save companies (or governments if they use them) lots of money, i.e. affords them greater profits but workers lose out. With DC schemes employers contribute only around 3-6% of salary rather than the 12-15% in a good DB scheme! Public sector DB schemes control about £300bn of assets, another reason this big business government is so desperate to privatise them by shifting to DC.

Despite the unstoppable ‘ageing society,’ these schemes are still making a surplus! The Local Government Pension Scheme (LGPS) has a £4-5 billion surplus of contributions over pensions in payment. Just as cuts to the social housing budget are completely unjustified, considering that council housing makes a surplus for the government every year, so too are attacks on DB public sector schemes which also make surpluses, and must be fought as in France. Big business is looting the welfare state to balance its books.

We should not be uncritical of how such schemes are run. Existing in an island of capitalism, these huge funds must invest in something to keep their value and as such are vulnerable to the vagaries and crises of the financial markets. We should also add that those who manage these funds charge a substantial commission and are part and parcel of the financial system which has cheated us out of so much.

But the embryo of a socialist alternative to pensions under capitalism does exist in the form of the ‘pay as you go’ (PAYGO) schemes that some public sector workers (mainly teachers, NHS workers and civil servants) are enrolled in. Do not be fooled by the pernicious propaganda being peddled, which claims these schemes are ‘unfunded.’ Terrifyingly huge and apparently unfunded government liabilities are being quoted for these schemes by the right wing, in order to ‘prove’ how public sector pensions have spiralled way out of control.

This is an outright lie! PAYGO schemes are not unfunded at all. Those currently drawing a PAYGO pension are in effect funded by specific taxes levied on current workers in PAYGO schemes. The extra taxes collected simply go into the government’s pool of cash and so can also be used to fund other useful public services if there is a surplus. In other words, they contribute to a government plan, a far more efficient and secure system than specific ring-fenced funds invested in risky assets. We should defend these schemes at all costs and argue for their extension to all public sector workers.

Nevertheless, we must also be clear that even this method offers no guarantees when the state ultimately is dependent upon the profitability of capitalism. As we know only too well, when capitalism goes into crisis, state finances are also thrown into crisis, and the capitalist class will demand their pound of flesh in the form of attacks on state spending. No pension is guaranteed under capitalism.

In response to the attempt to justify dragging public sector pensions down into the conditions of the private sector as some sort of perverse equality, we must argue for the dragging up of private sector workers to the conditions of the public sector. It is sufficient to compare the overall situation in the UK with other developed nations to demonstrate how intolerable the situation is – in the UK workers get 37% of their working-life earnings on retirement on average. In the Netherlands workers get 70%, in Sweden 76%, and in France 71%. It is true that as a desperate stop gap the government has suddenly pledged to increase the basic state pension, but this only demonstrates that the generalised programme of cuts is so severe that they had no alternative.

The working class won pension rights as a concession against the capitalist system. Perhaps more than any other social reform, private sector pensions are in contradiction with the logic of capitalism, which through its dependence on short-term profit and anarchic competition is unable to guarantee a stable future in any sense. As British capitalism has entered decline, it has only been able to sustain itself in more and more parasitic ways, in particular, through speculation and financial bubbles.

The boom in American and British capitalism that led to the current crisis was not based on useful investment but unproductive speculation such as using loans to fund the buying back of shares rather than capital investment. This was a tactic CEOs used to artificially inflate share prices and boost their standing.

£27bn of pension contributions were allowed to be skipped in the UK over last 15 years. This has directly led to the deficits in pension schemes workers are now faced with. The Thatcher government allowed firms to skip these obligations if the assets pension schemes invested in (i.e. shares on the stockmarkets) rose quickly enough. In other words, the artificial and unsustainable bubble in asset prices that the above quoted methods resulted in gave these same CEOs an excuse to take a pension ‘holiday’, providing a further phoney boost to short term profits. This shows the extreme irresponsibility of the capitalist class here, and how they, not our ageing, are to blame for the crisis. But this also provides a clue to the basis upon which British capitalism survives – what would have happened to all those employers had this £27bn been forcibly invested in the pension schemes? Add to this the hundreds of billions in unpaid corporation tax, and the crisis this has thrown state finances and public services into, and we get a glimpse of the unsustainability of the whole system. It must be overthrown.

The great paradox is that this vast swindle is based on our money. It is not enough that the profits of capitalism are made on the back of the labour of the working class. The deferred wages that pensions represent must also be jeopardised. The whole financial system is supported by our money – 50% of stock and bond markets are owned by non-wealthy individuals through pension insurance schemes.

Furthermore, Gordon Brown already cut what workers get from these funds by 15% by abolishing a tax credit for the schemes on the dividends they receive. However, when the tax credit was in effect, most of it was absorbed by the speculators anyway:

Now the answer given to the deficit in these schemes is to make us all work longer. Yet at the same time, we have upwards of 2.5 million unemployed. On the one hand, we have a generalised crisis in the whole economy, affecting both public and private sector pension schemes in similar ways, creating unemployment throughout society. On the other hand, the division and control of the economy by private financiers etc., presents a barrier to solving this problem. There should be no ‘ageing’ crisis at all when not only has productivity grown exponentially but there are millions who want to work.

The only way forward must be to take private sector pension schemes into public hands. Since public sector PAYGO schemes are indirectly funded from taxes on the private sector (the public sector wages they are taken from are ultimately funded by taxes on the private sector), why not extend the system, providing further efficiency gains, funding decent sized pensions for everyone from extended corporation tax? UK companies are now making huge profits but not productively reinvesting the money because of the limits of the market economy. If they will not productively use what they have accumulated from others’ labour, then they show their inability to lead society and production. If companies will insist on not investing but instead on resorting to financial jiggery-pokery, then we will insist on investing their capital on what we see fit, ensuring a decent future for all.

This must therefore go hand in hand with the genuine nationalisation of the banking and finance system into a single public institution, democratically managed for society’s benefit. If private companies cannot meet even the basic pension obligations to the workers they have exploited all their lives, then they must be nationalised and put under the control of said workers. That time has come.

The national pooling of pension schemes would allow for enormous rationalisation, security and efficiency gains. The following statistics give a glimpse of the wealth already existing but squandered by the capitalist system’s grossly inequitable distribution of wealth:

The Office for National Statistics (ONS) says that the median wage is £25,500, i.e. 50% of people earn less than £25,500. However, the mean (i.e. average) wage is £43,600. This means that if GDP was evenly divided amongst those in employment, each person would get £43,600. In reality, the majority of people get less than £25,500 due to inequalities. However if GDP was equally divided amongst ALL people, every man, woman, and child would get £20,590 per year, representing a massive boost to pensioners’ living standards. This would equal £48,590 per household on average. Of course, this reasoning is a little misleading, since a socialist plan of production would also massively expand production by doing away with unemployment and wasteful spending on wars, financial speculation etc. However it gives a hint of the real wealth at society’s fingertips even now.

Capitalist propaganda gives the impression of an unbearable burden on society, as workers have to give up a greater proportion of their wealth to a non-productive section of the population. This has resonance with workers because it is true – in truth, it points to the burden of the maintenance of the bourgeoisie, who live off the labour of workers!

We can give terrifying statistics of the ‘drain’ on society of maintaining the elderly but what does it really mean? That the secret to all human civilisation is producing a surplus so that we may liberate ourselves from unending toil. We may just as well give figures for the outrageous consumptive drain on resources that children represent! Only that, just as children will go on to be productive workers (although this is not guaranteed under capitalism), today’s pensioners were once the productive workers that fed today’s workers when they were children!

We want a system that guarantees a decent present and future for all. This should already be possible thanks to the massive advances in science and technique society has experienced. That system is socialism.