At the recent meeting of the World Economic Forum in Davos, the rich and powerful gathered to discuss a strategy for the defence of their system. In the past, the mood of this gathering has been one of confidence and determination. This year, however, it reeked of desperation. The ruling class has gone from victory celebrations to staring into the abyss within the space of just 25 years.

After the collapse of the Berlin Wall, the bourgeoisie was riding high globally. As we have pointed out many times, they thought they had won in the contest with "socialism", and believed that history had ended, as Fukuyama declared. That illusion was to be shattered by the crisis that began in 2007 and which is now entering into another, more critical, stage.

A depressed mood in Davos

Since the beginning of the crisis of 2008, nothing has been resolved. There was never a real recovery in the world economy after 2008 and now we are facing another worldwide recession. This time, however, all the measures that are meant to be used to get the economy out of a recession have already been used up.

What is worrying the capitalist class now is the so-called inverted yield curve. In the past, when short-term debt had a higher yield (interest rate) than longer-term debt – a situation that has appeared a number of times over the past few months – recession has followed in short succession.

Unlike in the past, in which they brimmed with confidence, the recent meeting of the world's rich and powerful at the World Economic Forum in Davos reeked of desperation / Image: Flickr, WEF

Unlike in the past, in which they brimmed with confidence, the recent meeting of the world's rich and powerful at the World Economic Forum in Davos reeked of desperation / Image: Flickr, WEF

This year, many world leaders, who have been stars of the gathering in the past (such as Macron and Trump) stayed away from Davos. Trump was participating in a game of chicken with Congress over the funding of his border wall (he blinked first, incidentally), while Macron was busy trying to quell the yellow vest protests, which had caused serious disruption to the French economy.

The reports from the gathering reflected the mood. Gideon Rachman commented in the Financial Times: “Everybody needs heroes – even Davos plutocrats. But the ‘global elite’ is currently out of enthusiasm and ideas.”

Harvard economist Kenneth Rogoff told the FT: “This is the flattest Davos I can remember. Normally, there is a star country or a star industry that everybody is talking about. But this year, there is nothing.” (‘Davos 2019: No more heroes for the global elite’, Financial Times, 28 January)

Rachman lists a string of previous heroes: Erdogan, Brazil, Macron, Bitcoin, China and Modi. All of them are currently in the dog house in one way or another. There was no source of enthusiasm, and a lot of reasons to be concerned.

One of the key concerns was about international trade. Martin Wolf, chief economics commentator at the Financial Times writes:

“Since the industrial revolution, the world economy has experienced two great waves of economic integration or, as we now call it, ‘globalisation’: in the late 19th and early 20th centuries and the late 20th and early 21st centuries. Conflict among the great powers, economic depression, nationalism and protectionism killed the first. The same combination, if in a different historical sequence, might yet kill the second.” (‘Davos 2019: globalisation faces bumpy road ahead’, Financial Times, 20 January)

In particular, the turn to protectionism on the part of the US is worrying:

“If the actions taken so far are not hugely damaging, far more so is the ideological rejection of core principles of the global trading system by its founder, the US: instead of liberalisation, there is protectionism; instead of multilateralism, unilateralism; instead of global rules, national discretion.” (Ibid.)

The US is no longer at the heart of trade liberalisation as it had been in the past. It is clear that protectionism is on the rise in the US, and the bourgeois are worrying that Trump’s protectionism isn’t just a temporary phenomenon, but is going to be a permanent feature of US policy, regardless of administration.

In addition, the feeling among the gathered dignitaries was that political control was slipping out of their hands:

“...the toxic combination of populism, protectionism and nationalism that is haunting countries from Brazil to the UK is unlikely to disappear soon – and technological changes such as artificial intelligence could make this worse. And that prompted many chief executives this week to engage in a new wave of discussions about how to dampen down the mood of anger, through social activism.” (‘Mood turns ‘a lot more gloomy’ at Davos’, Financial Times, 24 January)

The participants in Davos had many good reasons to be worried. The indications are that the growth of the past two years in the US, far from being the start of a sustained recovery, was only a temporary uptick fuelled by Trump showering money on the big corporations.

Rachman’s article finished with:

“It seems as if the world has disappointed Davos. But, then again, maybe Davos has disappointed the world.” (Ibid.)

A “synchronised slowdown”

On 7 April, the FT and the Brookings Institute released their TIGER index, which forecast “a synchronised slowdown” in the world economy. This was on the back of falling exports in a number of countries:

“The index fell partly because hard data indicating real economic activity has been weaker, with countries such as Italy falling into recession and Germany narrowly avoiding one and with the US economy losing steam as the effects of Donald Trump’s tax cuts wear off.” (Global economy enters ‘synchronised slowdown’, Financial Times, 7 April)

Taken on its own, it doesn’t make for particularly alarming reading. The world economy will reduce its rate of growth but still be growing at a rate of 3.3 percent. Professor Prasad of the Brookings Institute said “the slowdown did not yet appear to be heading for a global recession”, however “all parts of the world economy were losing momentum”. In other words, don’t expect things to get better. If anything, they’ll get worse.

The IMF in April forecast economic growth of 3.3 percent, which is a reduction from the forecast of 3.7 percent in October. World trade was forecast to rise by 3.4 percent, a reduction on the 3.8 percent that was the outcome of 2018. The fall was across the board in all major economies.

In January, the IMF also downgraded the growth rate from their previous prediction. At that time, Greg Ip wrote in the Wall Street Journal:

“The International Monetary Fund still thinks the global economy will grow a respectable 3.5 percent this year. But that is the second downgrade from a year ago when the IMF hailed ‘the broadest synchronized global growth upsurge’ since 2010.

“This latest disappointment isn’t the story; the real story is the serial disappointments that have dogged this expansion from the start.” (‘The Global Boom, Barely Begun, May Be Over', Wall Street Journal, 23 January)

Ip cites growth figures between 2010 and 2019 averaging 3.8 percent annually instead of the 4.4 percent we saw between 2000 and 2007, but even that modest growth is slowing down. He mentions Brazil, China, Germany, Japan, Russia and Britain, which all grew more slowly last year than in the previous eight years. Other countries like Italy, as we have seen, are already in recession.

One of the factors behind this is the attempts by the central banks to make credit more expensive. The ECB, the Federal Reserve and the Bank of Japan all tightened their monetary policies in the past year. Yet, this alone doesn’t explain the phenomenon. If this was a serious recovery, such minor adjustments shouldn’t have derailed it.

The problem runs much deeper than merely accidental decisions by central bankers or trade spats between the US and China, or Brexit. The reality is that the capitalist system is facing not a minor blip, not a short recession, but a major organic crisis. The fact is that capitalism has outlived its historic role. It can no longer develop the productive forces the way that it did in the past and has been living for decades on borrowed time.

Declining productivity

Since the beginning of the crisis, investment has been falling, particularly in the advanced capitalist countries. This has led to a decline in productivity. The productivity of labour is key to developing the productive potential of the economy. In a broad historical sense, it is determined by the skill of the workers and the level of machinery and infrastructure. It is an expression of the level reached by the productive forces, which is now slowing down dramatically.

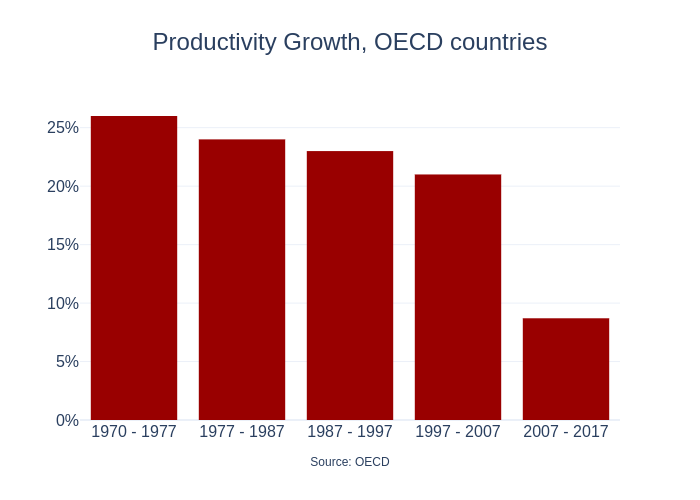

There was a trend of slowing down of the rate of growth of productivity in the OECD countries since the 1970s, from over 25 percent in seven years at the beginning of the 1970s to 21 percent in the decade leading up to 2007. Since then, productivity has grown by a mere 8.7 percent between 2007 to 2017. It should be noted, that part of the rise in productivity in the period leading up to 2007 was not through investment, but through working the existing workforce harder.

However, unlike with investment in new machinery, there is a limit to how much productivity gain can be had from intensification of work. On an annual basis, only twice between 1970 and 2006 was there less than 1.5 percent growth in productivity. This was in 1980 and 1982. But since 2006, labour productivity growth has only exceeded 1.5 percent once, in 2010, when it was 2.5 percent. So, what was the exception before the crash, has now become the norm. This slowdown in the growth of productivity is an indication of how serious the crisis is.

Falling investment

In the long run, the only way to achieve economic growth is through investment. Under capitalism, this typically either comes in the form of public investment in infrastructure or in the form of private investment in production. Only by raising the level of capital, can the capitalists raise productivity of labour in a sustainable way. However, private investments derive from the profits made by the capitalists. Ted Grant explained the relationship in the 1950s:

“The surplus produced by the working class, over and above its own subsistence is, apart from a small part consumed by the capitalists, ploughed back into production. The whole historic role of capitalism has been the development of the productive powers of society by the use of the surplus in capital construction.” (‘Will there be a slump?’, Ted Grant)

That’s why the bourgeois in times of crisis seek to expand the rate of exploitation of the working class, to lower their costs and raise profits. This means lowering wages and attacking working conditions but also slashing taxes on corporations to give them, as they say, “incentives”. However, in spite of all their attempts to raise profits over the past few decades, investment has been in continuous decline, even before the recent crisis.

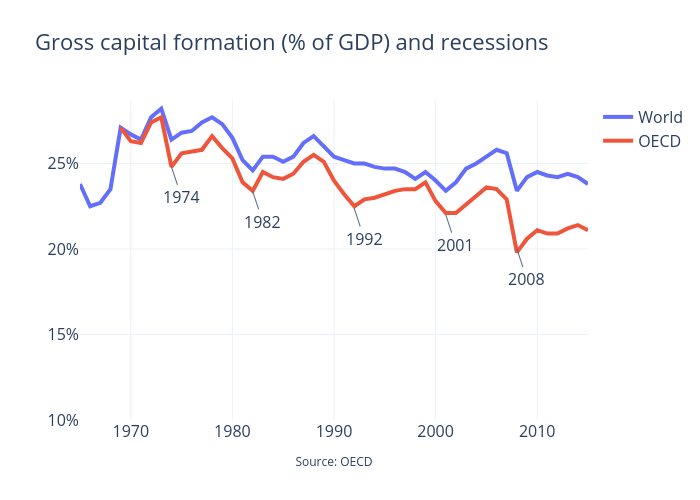

In the OECD countries, in particular, there has been a marked decline in the level of investment as a share of the total economy. From around 26 percent in the 1970s, Gross Capital Formation has fallen to around 21 percent today.

This trend of falling rates of investment has been going on for some time. In previous less serious downturns, every time there was a crisis, this was accompanied by a fall in investment, and although investment has tended to recover somewhat after a recession, it has never reached the level it was at before the crisis.

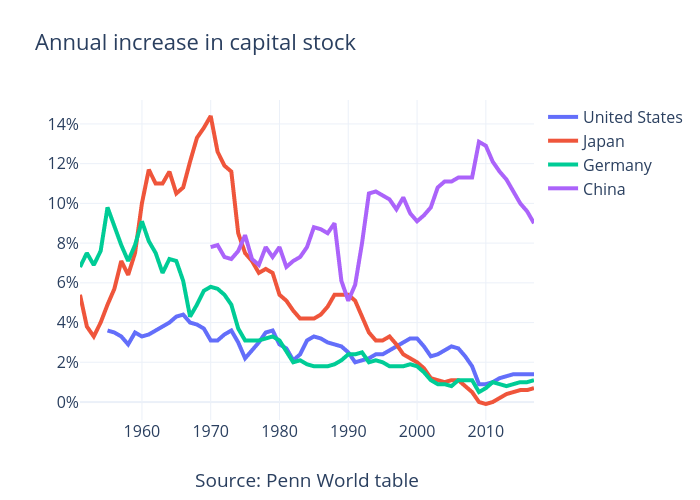

However, the fall in investment from 26 to 21 percent of GDP underestimates the impact that this has had. These figures count gross capital formation, meaning depreciation is not counted. If one looks at the increase in capital stock, the change that has taken place over the past few decades is even more dramatic.

The annual rate of growth in the total stock of capital used to be around 3 percent in the US, but has been steadily declining since 1980 and particularly after the crisis. The change in Germany and Japan is more dramatic. In 1950 and 1965, German capital stock grew by between 6 and 10 percent, but its rate of growth now is a mere 1 percent. Japan had an annual growth rate of over 10 percent between 1959 and 1973, but is now growing at less than 1 percent.

China is the exception. Its growth peak was reached in 2010. Much of the world’s manufacturing investment over the past three decades has been concentrated here, but this is also now reaching its limits, and we see the sharp decline in its rate of growth since 2010.

Essentially, this problem of lack of investment and the consequent fall in the rate of GDP growth reveals the scale of the problem. All the attempts of the bourgeois to raise the level of investment have failed, or at least have failed to restore capitalism to its previous state.

In the end, the only historic justification for capitalism is its ability to invest to develop the productive forces, but this is no longer taking place. In these conditions, the enormous growth in inequality serves only to increase the pile of money accumulated at one end of society, without any significant increase in investments. This brings out very clearly how capitalism has played out its role and needs to be removed if society is to move forward.

The debt addiction of the world economy

The manner in which the bourgeoisie attempted to avoid the crisis, was to cheapen credit and thus cheapen investments and consumer spending. For a whole historic period, they deregulated and lowered interest rates in order to keep investment and consumption going.

Unlike investment, however, consumption doesn’t in the first instance raise the long-term potential of the economy. It merely raises how much of the potential of the economy is being used. That’s why bourgeois economists tend to focus on what they call the supply side, basically the cost of production.

It remains a fact, however, that without consumption there will be no one to buy the goods that are being produced. So, as the capitalists attacked real wages throughout the 1980s, 1990s and 2000s, they had to replace the purchasing power of those workers with something else. This something else was debt.

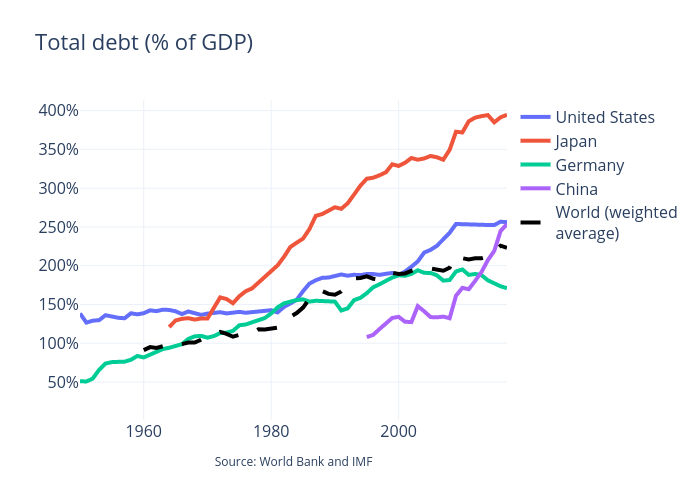

In different countries, different sectors of the economy have accumulated varying levels of debt. In Japan, for example, the government holds just over half of the total debt while in the US it’s only one third. In Japan, non-financial corporations hold 32 percent of the total debt, in Germany it’s 45 percent. What is common to all countries is that, over the past few decades, there has been a massive increase in total debt.

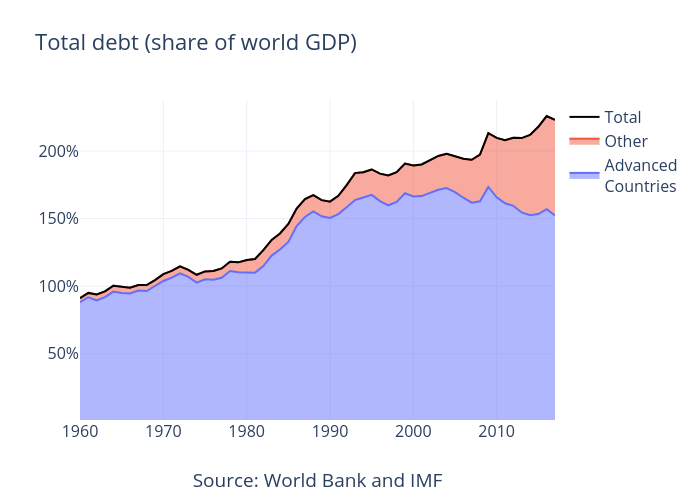

In 1960, according to one measurement, total debt on a world scale was around 90 percent of world GDP. It was a bit higher in the US, where it was around 140 percent. There had been a slight increase by 1980, but it was more or less the same (120 percent of world economy). After that, however, there was a marked increase on a world scale. By 1990, total debt on a world scale had reached 160 percent, and in the US, 180 percent. By 2007, it had reached 190 percent and 250 percent respectively. In Japan, the change was more dramatic, where debt rose to 340 percent in 2007, from being at a similar level to the US in 1970. Germany, after adding a lot of debt in the 1990s, actually paid back some of its debt, but that’s the exception, rather than the norm.

The debt in the period leading up to 2007 was particularly concentrated in the advanced capitalist countries of Western Europe, North America, Japan, Australia etc. However, the crisis has changed that.

In January 2007, the advanced countries held 160 percent and the rest of the world around 30 percent of world debt-to-GDP. 10 years later, the rest of the world held 70 percent, and the advanced capitalist countries 150 percent. Much of this is explained by the dramatic rise in Chinese debt.

There are other figures for debt that are much higher. The Institute for International Finance, for example, estimates world total debt to be 317 percent of world GDP, rather than the figure of 225 percent that is given by the historically comparable data from the IMF. Either way, the process remains the same.

This was a deliberate and “irresponsible” policy on the part of the bourgeois in order to prevent a recession at an earlier stage. The rise in debt was encouraged through repeated interventions through government policy: interest rates were cut time and time again, and lending was deregulated so as to allow banks to lend to clients that were less able to pay back the loans they had taken.

The subprime mortgage bubble, which was the starting point of the crisis of 2008, was only possible because the US government had abolished laws preventing banks from lending to people they knew couldn’t pay them back. The banks were gambling on the fact that, if they did have to repossess a house, it would be worth more than what the original mortgage was worth.

The effect of this policy was to keep a number of companies alive, and keep factories open that would otherwise have been forced to close. The same was true of households that could get mortgages easily, and also cheap credit in general, that would otherwise have been unsustainable. This intervention effectively prevented the market from playing its role of achieving “creative destruction”, to use the euphemistic term of Schumpeter. By keeping companies artificially alive they avoided mass layoffs, mass evictions and massive cuts in spending power. One might add that they were also concerned about provoking class struggle, which is what they were really afraid of.

For a whole historic period, the bourgeoisie attempted to avoid crisis with cheap credit, but that strategy created huge debt and only delayed the inevitable / Image: Brendel

For a whole historic period, the bourgeoisie attempted to avoid crisis with cheap credit, but that strategy created huge debt and only delayed the inevitable / Image: Brendel

The problem with debt, of course, is that eventually it has to be paid back, and not just paid back, but with interest. The interest compounds the problem. Unless whoever is borrowing the money is constantly adding more debt, their consumption power will eventually be cut because of the interest payments. So, in order to constantly expand purchasing power, or the ability of companies or governments to invest, one has to constantly add more debt. This is particularly the case if there is insufficient growth in the economy. Yet more debt creates more interest and thus generates a vicious circle.

In its latest report, the Institute of International Finance warns that “interest spending on public debt may divert spending from economically productive investments.” That’s in relation to public debt but the same is true for corporations. Solving the problem of investment and consumption by adding debt just makes the problem worse in the future.

The crisis in China

On the surface, China seems to be the exception to the rule of general decline, and the Chinese economy helped pull behind it a number of other economies in the first years after the crisis. Brazil, South Africa and Australia were all pulled behind the growth of China, exporting raw materials to feed Chinese industry. However, that has now come to an end. The Chinese economy is slowing down, and quite dramatically.

Since 2008, Chinese debt has exploded as the government attempted to keep China out of the general slowdown. From just over 130 percent of GDP, total debt reached 250 percent of GDP last year. In a certain sense, the Chinese ruling elite did in 10 years what the US had done in 30.

However, this level of debt increase is unsustainable in the long run and the effect of credit expansion has been reduced over time:

“In 2008, according to a report issued last summer by the IMF, 1 trillion yuan of credit was required to generate one trillion yuan of economic output. In 2017, the most recent year for which such data is available, 3.5 trillion yuan of credit was needed for the same scale of GDP creation.” (‘As China Faces Slowdown, Stimulus Will Have Smaller Global Reach’, Wall Street Journal, 16 March)

This means that the economy has to add more and more debt to achieve the same level of economic growth. The limit of this policy has now been reached. As a result, the Chinese government changed tack in the past couple of years. It has attempted to cut back on credit and develop other methods of growth. Part of that was an attempt to push the Chinese economy to compete in new areas, for example, “Made in China 2025”, which is a major factor in the US-China trade war.

China has posted its slowest growth since 1991, which has big implications for the whole world economy / Image: Socialist Appeal

China has posted its slowest growth since 1991, which has big implications for the whole world economy / Image: Socialist Appeal

The withdrawal of some of these credit lines has already seen annual Chinese growth fall to 6.6 percent, which is much higher than in other parts of the world. But it is still the slowest Chinese growth since 1991, and a significant fall from the 8-14 percent it was achieving between 2002 and 2011. As mentioned, this has already plunged a number of countries that were exporting to China into recession.

This year, instead of credit, the government has attempted methods similar to those carried out in the West:

“The constraint from already-high debt levels explains why the nature of Beijing’s pro-growth package is changing from the financial-crisis era— from credit to tax cuts and government spending.

“The shift might not be potent as quickly as past efforts: Ms. Wang [chief China Economist at UBS] thinks companies are likely to keep most of the saved taxes rather than spend it, in light of the slowdown and uncertainty caused by the U.S.-China trade tensions.” (Ibid.)

The stimulus will undoubtedly have an effect but it will be insufficient to keep Chinese growth from slowing down further. This spells trouble not just for China, but also for a host of countries that have been relying on Chinese growth to keep their own economies growing.

The US economy is slowing down

The largest economy in the world remains that of the US, and it has played an important role in the slight recovery that the world economy experienced. However, much of that was of a temporary nature:

“Recent US strength is also due primarily to fiscal policy: a big cut in tax rates at the start of 2018 and a boost in federal spending. The corporate rate cut should in theory boost investment. But while investment did accelerate last year, the Penn Wharton Budget Model, an academic group, attributes all of that acceleration to a surge in oil prices which stimulated more drilling and extraction of shale oil. Neither the fiscal stimulus nor the oil price increase is likely to be repeated.” (‘The Global Boom, Barely Begun, May Be Over’)

The massive handouts to corporations that were carried out by the Trump administration at the beginning of last year did indeed have an effect but it was temporary, and it was at the expense of massively increasing the federal budget deficit (from 3.5 percent of GDP to 5.1 percent). It did not have a significant impact on investment and so did not create the potential for any long-term upswing.

Now, the economy is starting to slow as the effects of the stimulus withdrawal are felt, combined with the US-Chinese trade spat. The figures for the first quarter of 2019 looked good, on the surface. The economy grew by 3.2 percent compared to the year before. But that figure hides the fact that a large part of this growth was due to increases in inventories. Companies have been restocking ahead of possible tariffs if the China-US trade negotiations should go badly. After stripping away trade, inventories and government spending, the economy only increased by 1.3 percent, which is half the rate of the fourth quarter of 2018. In the fourth quarter, the economy grew by a mere 2.2 percent, a fall compared to the third quarter, when the economy grew by 3.8 percent. So, rather than being a cause for celebration, the stock markets fell on the release of the latest figures. Below the surface, it seems the US economy is slowing down.

Monetary policy used up

The key to controlling the availability of credit is the central banks. They use the levers at their disposal, primarily interest rates, to try to even out the economic cycle. Yet, they are unable to fundamentally solve the problems of the capitalist economy, as Ted Grant pointed out some years ago:

“Incidentally the Radcliffe Commission demonstrated conclusively the fallacy that the economy was controlled by monetary measures. In fact, as Marxists have always argued, the reverse is the case. The development of the economy in the direction of inflation or deflation compels the raising or lowering of the bank rate.” (‘Will there be a slump?’)

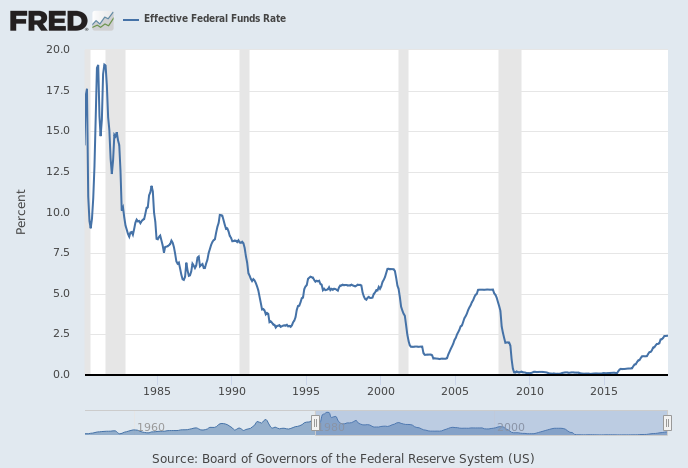

Indeed, the lack of effective demand has caused tremendous deflationary pressure. In order to raise investment and consumption, the central banks have resorted to an unprecedentedly loose monetary policy. The interest rates over a whole historic period have been in steady decline.

Every time there has been a recession, the federal reserve rates have fallen by around 5 points. However, since 1980, every time they fell, they failed to rise back to their pre-recession level. The result is that, by the time the latest recession came around, the federal reserve rate was only at 5 percent, and after reducing it 5 points, it stood at zero. Yet even at 0 percent interest, inflation still wouldn’t rise, which is deeply worrying for the thinking bourgeois:

“The reason is that much of the world appears to be stuck in a low-growth equilibrium and it can’t tolerate interest rates as high as it once did. The ‘neutral’ interest rate – high enough to contain inflation, low enough to avoid recession – is much lower than before. For example, if the Fed’s last rate increase turns out to be its last, as many suspect, then the new real (inflation-adjusted) neutral rate in the U.S. is less than 0.5 percent, compared with a historical 2 percent.” (‘The Global Boom, Barely Begun, May Be Over’)

As the title of his article suggests, Greg Ip is concerned that, 10 years since the beginning of the crisis, the real interest rate is just half a point above zero. This is significantly lower than in the past.

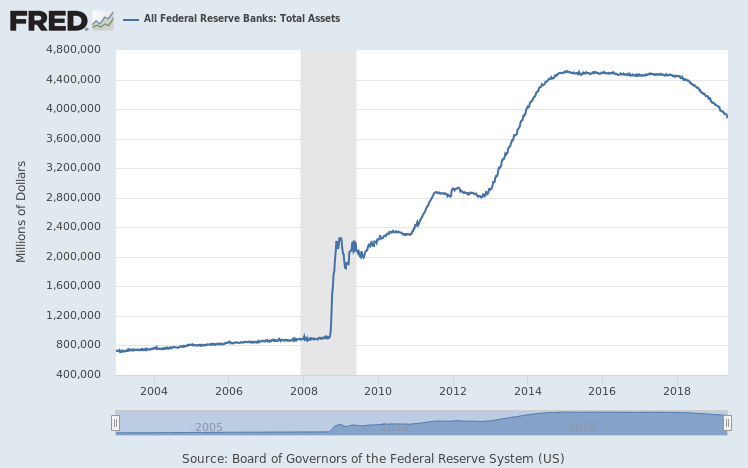

Printing money – without inflation?

The dire state of the economy led to unprecedented Quantitative Easing programmes. It shows the depth of the crisis that the Federal Reserve could effectively print $3,500 billion without it having a significant effect on inflation.

The reason was that this money largely wound up in the hands of big corporations and banks who saw no reason to invest any of it. They were already sitting on heaps of cash and an extra line of credit wasn’t really helpful. Instead the money was used for speculative purposes.

There has been a raft of record art auctions, with a Saudi prince paying $450m for one of 20 known Da Vincis. Housing bubbles have been growing in North America, Northern Europe, and, crucially, China. The stock exchanges have been growing in value with the Dow Jones Index reaching a record 26,000, twice as high as before the crisis (the same increase as the S&P 500). Other non-US stock exchanges have registered substantial increases, if not as high as the US.

These “asset” (stocks, real estate, art, etc.) bubbles had the effect of also massively increasing wealth disparity. Many of the figures about the immense wealth inequality stem from the fact that the assets of the rich have massively increased, due to cheap credit.

Another effect of the quantitative easing programmes was to simultaneously depress the US currency whilst at the same time offering very cheap credit. This combination was very bad for a number of countries that started to borrow in US dollars.

When the US policy shifted to tightening credit, which pushed up the US$ and raised the cost of borrowing, these countries wound up in a very critical situation. Turkish non-financial companies, for example, managed to build up debt worth almost 50 percent of GDP denominated in US$ and Euros. When the Lira fell, this debt suddenly increased by 10 percent. The Argentinean government debt rose by 30 points, from 57 percent to 86 percent last year. It now holds 64 percent of GDP worth of debt denominated in foreign currency as a result of a collapse of the Peso. Thus, the changes in US monetary policy are having severe repercussions for other countries.

Trade wars making a bad situation worse

One of the key concerns of economists has been the prospect of trade war. A lot of decisions under capitalism are based on projections of the expected size of the market, sometimes quite far in advance. There are the more short-term questions of how many raw materials to buy and how many products to produce, but then there are more long-term ones about whether to buy new machinery or build new factories, which are based on the expected market years in the future. Insecurity about the world markets will cause companies to hesitate when making commitments.

When Trump threatens a 25 percent tariff on imports from China, it generates a lot of uncertainty. When companies pass on this cost to customers (and most of it will inevitably be passed on), it will reduce sales. Thus, the factories you built or the machinery you purchased will be able to produce much more than you can sell, meaning that you won’t be able to earn back the money the machinery cost. In a certain sense, threatening tariffs is almost as bad as imposing them. Even if you never impose them, if the markets take you seriously, they will postpone investments.

The dispute with China has provoked serious concern because it deals with the two biggest economies on the planet, but tit-for-tat trade skirmishes are on the order of the day everywhere / Image: IDoM

The dispute with China has provoked serious concern because it deals with the two biggest economies on the planet, but tit-for-tat trade skirmishes are on the order of the day everywhere / Image: IDoM

Furthermore, when companies start building their supply chains, they want predictability. They want to know what the costs of their parts will be. Consider Apple’s iPhone, which pulls in components from the US, Japan, South Korea, Taiwan and the EU, in order to then be assembled in China. The bulk of the labour is done in other countries, but it is then assembled in Foxconn’s huge factories in China. So, Apple is vulnerable on a number of fronts to sudden surges in tariffs or other obstacles to trade. This is why they were fighting a battle against the tariffs last year. Much of the world’s production is done in this way, meaning that multinational companies are very vulnerable to trade wars.

Trump has behaved like a bull in a china shop on the world stage, attempting to bully US allies and enemies alike into changing trade terms. The dispute with China has provoked the most concern because it deals with the two biggest economies on the planet.

Trump, according to different reports, had been pushing for a deal, but of course, it had to be a “good deal”. What that means is that it has to be a deal that he could somehow sell to his electorate as “progress”, something to make it appear that he is serious about “making America great again”. Now, the two powers seem to be on a collision course again, with Trump imposing another round of tariffs and the Chinese threatening countermeasures. Most likely they will eventually reach a deal of some sort, but whether the tariffs will remain or not remains to be seen. But a deal will not be the end of the story, as the bourgeois are acutely aware:

“What really worried some chief executives was a perception that even if the Chinese agreed to make significant concessions on tariffs to the Americans, China and the US are heading for a long-term clash about who will control technologies such as 5G mobile.” (‘Mood turns ‘a lot more gloomy’ at Davos’)

Essentially, the struggle between the imperialist powers is intensifying as a result of the crisis. A deal cannot resolve this question. New technologies are being developed and there will be a struggle over who is to control the new markets. That is what “Made in China 2025” is all about, and it is precisely what the US and the EU are fretting about. China wants to take a large share of the expanding markets in the fields of aeroplanes, electric cars, solar power and semiconductors.

In the shorter-term, Chinese companies ZTE and Huawei are giving their competitors a run for their money, and the US, as is well known, is attempting to block them. Accusations of spying are probably not completely unfounded. In fact, Snowden revealed precisely how much the US relies on its multinational companies for its spying, so the US spy agencies know that it can be done. More to the point, however, the US is trying to stop Huawei getting the lion’s share of the 5G market. The excuse of national security is increasingly stretched, as US senators are now arguing that Chinese train exports to the US put US commuters at risk of being spied upon. Clearly, this has nothing to do with spying and everything to do with the fact that the Chinese train manufacturers are beating their US rivals.

There is a serious threat of the two economies decoupling, breaking supply chains and dislocating trade routes. Foxconn is considering moving the production of iPhones to India, GoPro is moving production to Mexico, Ford is scrapping plans to export cars from China to the US etc. Investment in the US by Chinese companies has stopped and the flow from the US to China has slowed. The tariff conflict over the past year has unleashed a wave of anti-Chinese protectionism, threatening world trade.

The threat of protectionism

This struggle over markets is not merely being waged between the US and China. The Europeans have their own disputes. To name a few examples:

- The battle over the control of Nissan, where the Japanese board revolted against French government plans for majority-owner Renault to take over. This involves a court case in which Carlos Ghosn, the former CEO of both companies, is charged with financial misconduct.

- Multiple complaints to the WTO about state subsidies to Boeing and Airbus, leading the WTO to rule against both the EU and the US. This has led the EU and the US to engage in tit-for-tat threats of tariffs.

- The grounding of the Boeing 737 MAX was carried out first by China, then by the EU, and finally the US.

- Trump has for some time been urging car tariffs on EU exports to the US, particularly German exports.

This paints a picture of increasing tension on a global scale, where the main imperialist powers are engaging in tit-for-tat actions to defend the interests of their multinational companies. This threatens the basic premise of how the global economy has been structured.

The German and French governments have recently entered into conflict with the European Commission over the question of competition legislation. The two governments were favouring a merger between Alstom and Siemens train manufacturers but the EU commission refused. By merging Europe’s two biggest train manufacturers, they were hoping to create a competitor to Chinese CRRC, which is the biggest manufacturer in the world. However, the European Commission blocked the merger, because of the dominant role the new company would have on the European market.

Both the French and the German governments demanded changes to legislation to allow for the creation of such European “champions”. They proposed that a council of EU ministers could have a national veto over competition decisions. Manfred Weber, German MEP and lead candidate for the European People’s Party, said he would propose changes to legislation to create special exemptions where mergers would result in European “champions” and that he wanted “more Airbus companies” (note that Airbus controls roughly half the world aeroplane market). The Federation of German Industries (BDI) also supported changes in this direction.

The BDI and the German economy minister, Peter Altmaier, went even further. The BDI proposed state subsidies (to counter Chinese subsidies). Altmaier proposed a state investment fund to counter foreign takeovers of companies whose “technology is crucial to Germany’s future competitiveness” and also said that it was in Germany’s “national political and economic interest” to protect “champions”.

What is being proposed is basically the creation of massive European monopolies to take on particularly the Chinese but also other monopolies. In a sense, it’s a further development of what Lenin described in Imperialism: the Highest Stage of Capitalism, when each nation state had a few monopolies in each industry. Now, they are effectively attempting to create a few gigantic monopolies worldwide, where the EU will have its own monopolies, or, as they prefer to call them, “champions”.

Attempts to merge European multinationals into "champions" is effectively the same as protectionism / Image: PAU

Attempts to merge European multinationals into "champions" is effectively the same as protectionism / Image: PAU

This kind of development is effectively the same as protectionism, which is not lost on the business press. The Financial Times terms it: “the latest sign of growing protectionist sentiment in Berlin” (‘Altmaier urges EU to protect technology from Chinese rivals’, 17 February), and they are worried. Alan Beattie, European lead writer, comments: “The creation of European champions risks creating a permanent state of market-concentrating warfare.” The question is: how will the US, Japan or Canada respond to such actions by the European Union? Inevitably they will have to respond with their own state subsidies.

In general, the bourgeois is very worried about what effect this rise of protectionism will have on the world economy. The IMF commissioned a study as part of its World Economic Outlook report this April. It goes into detail on the role that free trade (‘globalisation’) has played in investment. It concludes that trade integration has contributed up to 60 percent of the fall in the price of machinery relative to the price of consumer goods. The report suggests that a 1 percentage point reduction in tariffs resulted in a 0.4 percentage point increase in investment.

“Trade tensions and sluggish productivity growth could slow the decline in the relative price of machinery and equipment, which would hold back investment growth worldwide.” (“Why Investment May Come Under Threat”, IMF Blog)

The move towards protectionism would have a decisive impact, not just in the short-term, but also in the long-term. It risks leading to an increase in the cost of investment, and a consequent fall in new investments. Protectionism raises the prospect of disrupting supply routes, raising the cost of goods, and also raising the cost of investment. If the IMF is correct in its findings, and there is no reason to think that it would be wrong, it means that the already limited investment in the world economy could fall even further.

The political consequences of the crisis

The economists of the world have of late been forced to recognise that politics play an important role in the world economy. For two years running, the IMF has listed political risks as the most important risk factors to the economy. Whereas machinery and raw materials that get discarded make no noise or protest, workers do. The workers and the poor have a tendency to get angry when their living standards get threatened by cuts, layoffs and attacks.

This has slowly dawned on the bourgeois, who always react empirically to events. This was at the forefront of participants’ minds at Davos:

“Worse still, the spectre of political risk is now haunting the C-suite to a degree that few western executives have seen before in their careers. ‘Generally speaking the economy is still relatively strong: we see that the demand for IT continues to grow,’ said Antonio Neri, chief executive of Hewlett-Packard. ‘But there is political instability – we have globalisation and nationalism happening at the same time.’” (‘Mood Turns ‘a Lot More Gloomy’ at Davos’)

The rise of Trump, a protectionist, as the head of the most powerful imperialist power, is a sign of things to come. The same development can be seen in Italy and Brazil, where right-wing forces are in government that are beyond the direct control of the bourgeois.

The British Conservative government’s handling of the Brexit saga is another source of bafflement to the world bourgeois:

“Britain has disappointed Davos by voting for Brexit – and merely baffled delegates at this year’s conference by draping vast banners over the Belvedere Hotel proclaiming, ‘Free trade is great’.” (‘Davos 2019: No More Heroes for the Global Elite’)

The rise of various types of right-wing nationalist movements poses a serious threat to world trade, and economic stability. Marx and Engels pointed out in the Communist Manifesto that bourgeois governments are merely “a committee for managing the common affairs of the whole bourgeoisie.” However, in the present world situation, those governments, under the pressure of mood swings in society, are developing a certain independence from the bourgeoisie. In the end, even bourgeois politicians have, in one way or another, to convince the workers to vote for them.

Cameron’s ill-fated attempt to keep the Tory Party together led to Brexit. Theresa May’s attempt to keep the Tories together has led the country to the brink, and the party is now facing an implosion. The attempt of the Brazilian bourgeois to get rid of Dilma, a move which was opposed by imperialism at the time, prepared the way not for rule by the traditional bourgeois parties that impeached her, but for Bolsonaro. Macron was to be the salvation of France and Europe, but merely prepared the biggest mass protests for decades. Events appear to be conspiring against the ruling class, but they are merely reflecting the deep anger that exists against the existing order.

The CEO of the Japanese Suntory group, Takeshi Niinami, commented:

“People [in Davos] are realising that we have to start operating for the social good or we risk being kicked out – we have all this nationalism and populism and we know that if the economy is gloomy this could get worse.” (‘Davos 2019: No More Heroes for the Global Elite’)

The reality of the situation is gradually dawning on the bourgeois. “Operating for the social good” is only so much empty phrase-mongering, although with their backs against the wall, they might make temporary concessions on a number of fronts.

This sentiment is increasingly echoed by a number of the big bourgeois. In April, two leading bankers, the head of JP Morgan Chase and BridgeWater Associates, commented on this. They both referred to the question of inequality, concluding, as Jamie Dimon of JP Morgan Chase put it: “Simply put, the social needs of far too many of our citizens are not being met.”

In Jamie Dimon’s letter, which forms part of the company’s annual report, one even finds the following heading: “Is capitalism to blame? Is socialism better?” Unsurprisingly, he concludes that capitalism is superior, but the fact that he feels the need to comment on it is instructive.

Ray Dalio, one of the founders of BridgeWater Associates, goes further. This leader of the world’s largest hedge fund gives this damning indictment:

“Over these many years I have also seen capitalism evolve in a way that it is not working well for the majority of Americans because it’s producing self-reinforcing spirals up for the haves and down for the have-nots.” (‘Why and How Capitalism Needs to Be Reformed’, 4 April)

When faced with the crisis in 2008, the ruling class internationally pulled out all the stops to rescue the system, but they merely reinflated the bubble. In a sense, it was “irresponsible”, but they feared the consequences if they were to let the economy freefall in the way that it did in the 1930s. Yet, even this relatively mild austerity has caused the bourgeois to lose control of their political representatives. Inequality has skyrocketed and it is clear that what little recovery there has been, has only benefited the wealthy. It does not bode well for when the next recession comes.

Dalio draws the following conclusion from the present situation:

“Disparity in wealth, especially when accompanied by disparity in values, leads to increasing conflict and, in the government, that manifests itself in the form of populism of the left and populism of the right and often in revolutions of one sort or another. For that reason, I am worried what the next economic downturn will be like, especially as central banks have limited ability to reverse it and we have so much political polarity and populism.”

Will there be a depression?

It is not an accident that Germany is spearheading the move towards protectionism in Europe. The German economy is struggling with the slowdown in China, as well as economic difficulties in Europe. Exports fell 1.3 percent in March, which was more than the forecast 0.5 percent. Manufacturing was hit hardest. Orders in February were down 8.4 percent compared to February 2018.

The Italian economy was already in recession in the second half of last year. Germany narrowly avoided a technical recession since it only suffered a fall in GDP of one quarter between July and September, and GDP stagnated in the fourth quarter. The Euro area as a whole grew by 0.1 percent in the third quarter and 0.2 percent in the fourth. This is hardly confidence-inspiring. Joerg Karemer, chief economist at Commerzbank commented: “We are currently in a gray area between a pronounced slowdown in growth and a recession”.

The ECB met the threat by announcing another stimulus package. As the interest rate is already at nil or just below, it had to resume its bond-buying programme that it only ended in December. This new bond-buying programme is likely to have little effect, as the Wall Street Journal points out:

“The effectiveness of the ECB’s new cheap funding may be limited, some economists say, because of the extent to which an uncertain economic outlook, rather than banks’ inability to secure funding, has crimped lending.” (‘As Draghi Moves to Avert Recession, Eurozone Looks for a Jolt’, Wall Street Journal, 8 March)

In other words, the banks have plenty of money, they just don’t want to lend it to their customers, because they are not sure their customers will be able to pay it back. The ECB has very limited scope for stimulating the economy.

“‘There isn’t much [the ECB] can do that’s powerful’ said Dirk Schumacher, chief economist at Natexis in Frankfurt . ‘What’s powerful is fiscal policy.’” (Ibid.)

The next recession will be much deeper and harsher than that of 2008-9. The crisis is about to enter an even more serious phase / Image: Flickr, WEF

The next recession will be much deeper and harsher than that of 2008-9. The crisis is about to enter an even more serious phase / Image: Flickr, WEF

However, Northern European governments have proven themselves unwilling to raise their budget deficits in order to help the general European economy. Doing so wouldn’t solve the problem of their respective export industries. Germany even has fiscal discipline written into its constitution, so a Keynesian stimulus of any significant scale is unlikely, unless things get drastically worse. In the end, the prospects for the European economy look dim.

Many of the “developing countries” are struggling as a result of the combined effect of the crisis in Europe and the slowdown in China. Brazil went through two years of 3 percent GDP loss, although it has recovered slightly since. The GDP of Argentina, the second-largest economy in South America, fell by 2.7 percent last year and is projected to fall by another 1.2 percent this year. The IMF is also projecting a 2.5 percent fall for Turkey.

The world economy goes through downturns every six to 10 years. It’s part of the normal business cycle. The present recovery in the United States has been the longest since the 1960s. Everyone knows that another downturn is coming. It’s merely a question of when.

However, this time, the tools that they used to get out of previous recessions are no longer available. Interest rates for all major central banks are at historic lows for this point in the business cycle. The Japanese and the European central banks, as well as a host of smaller countries’ banks, have rates at or below zero. Government budget deficits are large in major economies and state debts are significantly higher than they were in the past. They pulled out all the stops in 2008 and rescued the situation temporarily, but now everything is turning sour again.

On that basis, the only conclusion that we can draw is that, when the next recession comes, it will be much deeper and harsher than that of 2008-9. The crisis is thus not over at all. It is about to enter an even more serious phase, with all the consequences that entails for social instability and class struggle.