The 1997 economic crisis that hit the South East Asian countries, in the changed conditions of Indonesia led to revolution in 1998 and the ousting of the old regime. However, it failed to remove the bourgeoisie from power, who adopted “Reformasi” as a means of channelling the revolution down safe lines; while granting “democracy”, however, they pushed for a greater intensification of the exploitation of labour and for greater “liberalisation”. Important lessons have to learnt from this period by the activists of the left in Indonesia today.

1997/98 Crisis and Reformasi

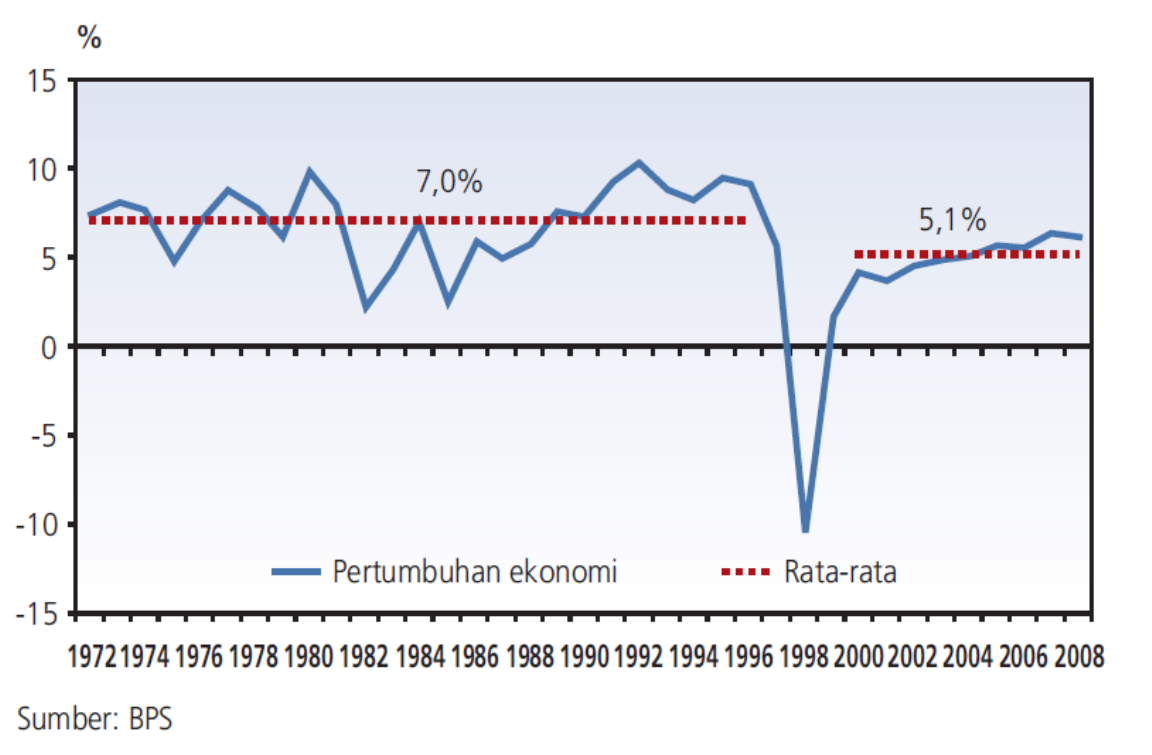

In the seven years preceding the 1997 economic crisis, there was a huge influx of capital into the private sector, from $314 million in 1989 to $11.5 billion in 1996, an increase of 3500%.[1] This massive private capital, most of it speculative short-term capital invested in the real estate sector, created a bubble economy that burst in the 1997 Asian financial crisis. That crisis was devastating. From an average annual growth of nearly 7%, real GDP contracted by nearly 14 percent in 1998. The rupiah depreciated from Rp. 2,450 to 14,900 to the US dollar between June 1997 and June 1998.The capitalist government, with the help of the genuine reformists, was quick to bail out the failing banks and finance companies. As a result, government public debt rose from zero before the crisis to US$ 72 billion, a massive amount that the workers are forced to pay for.

Foreign Direct Investment also dropped massively. The inflow of FDI amounting to US$5.6 billion in 1996 turned into an outflow of US$4.6 billion in 2000. Foreign private capital continued to leave the country as it stood at US$ -1.5 billion in 2004. Although FDI began to flow in again in 2005 and it stood at US4.1 billion in 2006.[2]

In the aftermath of the crisis, growth remained subdued with real GDP increasing by no more than 5% annually during 1997-2004, and by around 5.5% during 2005-2006, and 6.3% in 2007.

Figure 1. GPD Growth in Indonesia[3]

The economic crisis was the straw that broke the camel’s back. The 32 years of development unravelled in an explosive manner. The prices of basic necessities skyrocketed. Suppression of democracy was becoming more and more unbearable, with the 27 July incident in 1997 – the attack on the PDI headquarters – being the turning point. PDI and Megawati became the rallying point for the democratic struggle.

Soeharto’s regime was overthrown by the masses. 32 years of dictatorship were ended overnight when millions of Indonesians took to the street and forced Soeharto to resign. However, the “Reformasi” brought what it was designed to bring: cosmetic reform but no fundamental change. Reform in a period of economic crisis can only mean counter-reform, and this is exactly what happened. State enterprises were privatized and subsidies were lifted; a rampant neo-liberal agenda was implemented. The “Reformasi” did bring more democratic space, in spite of the reformists. However, it also brought more freedom for the capitalists to exploit the masses.

After 12 years, it has become clear to everyone that the “Reformasi” has failed to bring any fundamental change to society. While the “Reformasi” dealt a heavy blow to the capitalist regime, forcing Soeharto to resign and opening up democratic space – albeit a bourgeois democratic space –, it failed to solve the fundamental problem facing millions of workers, peasants, fishermen, youth, and urban poor. Poverty is still at an all-time high. The percentage of the population living on $1 a day (extreme poverty) in 1996 – the heyday of the Indonesian economic boom – was 7.8%, and in 2006 it was 8.5%. However, if we take $2-a-day as the poverty line, the incidence of poverty in 2006 jumped to 53%.[4] This means that more than half of all Indonesians live far below the GPD per capita of $3900 (2008 value). The poorest 10% only consumes 3% of the wealth while the richest 10% consumes 32.3%.[5]

The failure of the “Reformasi” has been so blatant that even the masses have started to reminisce about the “good old days” under Soeharto when poverty was more bearable and there was a sense of stability. Under the guise of democracy, the degree of exploitation has actually increased. That is logical, since for the ruling class democracy means freedom to exploit. As a consequence, the neo-liberal agenda has been implemented even more rigorously in recent years. Many state companies and properties are being privatized. State subsidies are being abolished. No wonder the masses are tired of the current situation and sceptical of what the 1998 "Reform" has brought.

2008/2009 World Recession

Indonesia could not escape the impact of the world recession which was triggered by the housing mortgage crisis in US. (For a fuller analysis of the world recession, read the The Crisis of Capitalism and the tasks of the Marxists – Part One, Part Two and Part Three). In Indonesia, the economy in the first three quarters of 2008 still gave room for optimism, growing by more than 6%, but when the recession hit, it contracted to 5.2% in the fourth quarter. Reminiscent of the 1997 crisis, the Rupiah suffered over a 30% depreciation against the US dollar in the two months of October and November 2008. The stock market lost almost half of its value between January 2008 (2627.3) and December 2008 (1355.4)

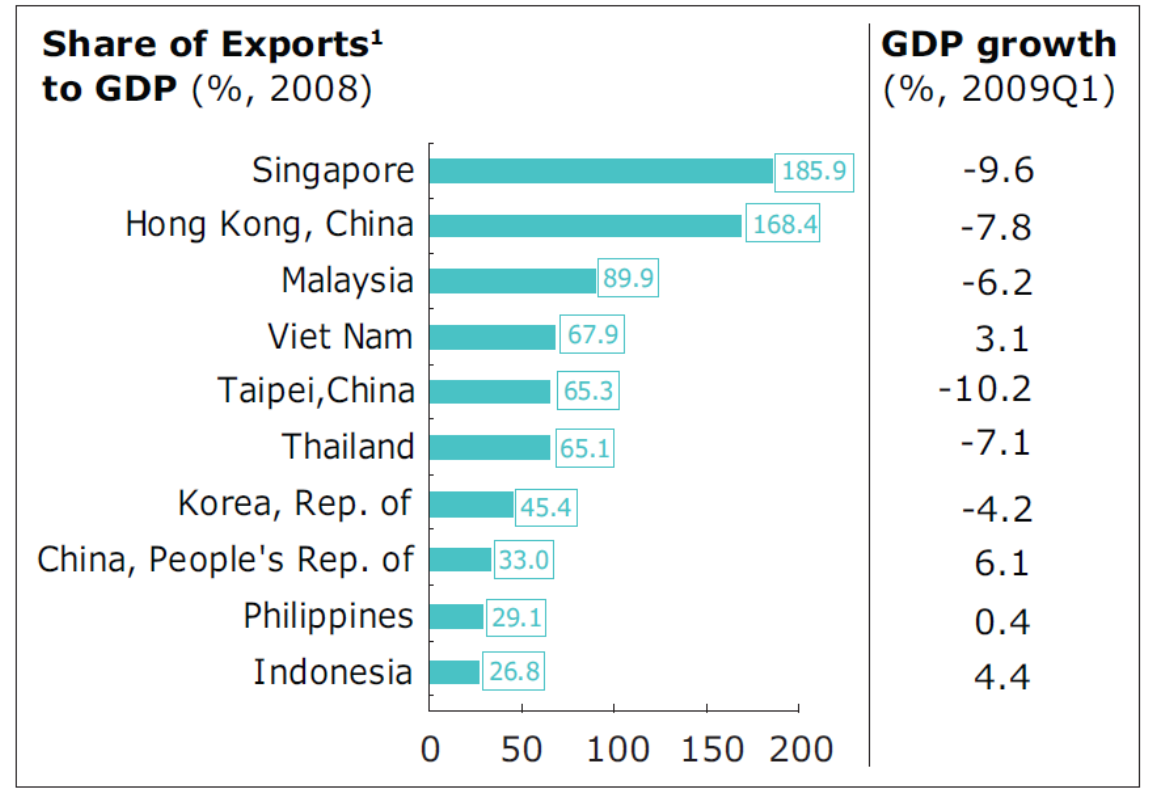

However, Indonesia recovered quickly from this recession. In the first half of 2009, Indonesian GDP grew by 4.2%, the biggest in Southeast Asia while other countries in the same region experienced falls in GPD, Singapore -3.5%, Thailand -4.9%, and Malaysia -5.1%. In 2009, Indonesia posted a 4.5% GDP growth, with an impressive fourth quarter growth of 5.4%. Similarly, in the first half of 2009, the Jakarta Stock Exchange rebounded rapidly, third fastest after Shanghai and Mumbai. By the end of 2009, it had returned to its pre-crisis value.

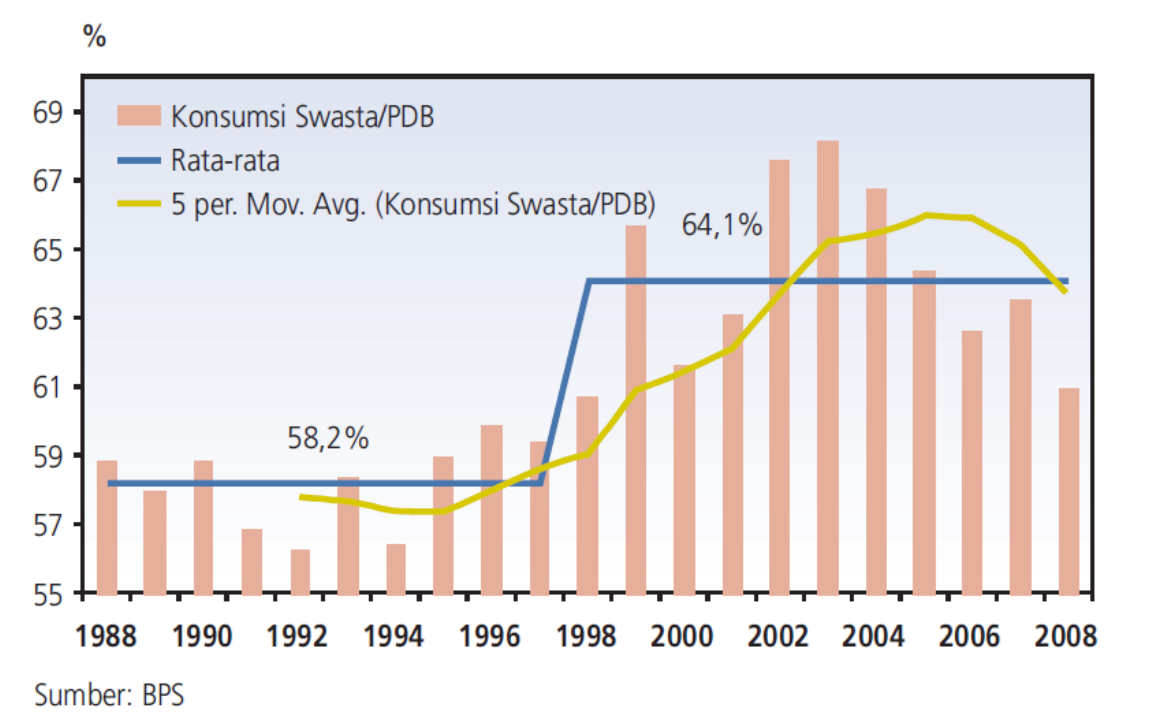

The Indonesian economy was not hit by the recession as severely as other South East Asian countries because in the recent decade its growth had been based on domestic consumption as opposed to export trade. Domestic consumption after the 1997 crisis has increased from around 58.2% to 64.1% of the GDP

Figure 2. Domestic Consumption in Indonesia[6]

Another factor is that export values in the Indonesian economy are only about 25% of GDP, while many countries in Asia have a much higher export to GDP ratio. With the decrease in the growth of the volume of global trade from an average 8.1% in the five years prior to the crisis to 4.1% in 2008 and -12.2% in 2009, countries that depend on exports were hit immediately and more severely.

Figure 3. Exports Share and GDP Growth – Emerging East Asia[7]

Limited direct exposure to the US mortgage meltdown also shielded the Asian banking system from the initial shock of the financial crisis. Of the total US$1.5 trillion in write-downs and credit losses reported worldwide since July 2007, only US$39 billion, or about 2.7%, come from Asian financial institutions – the bulk of which comes from Japan and to a lesser extent China.[8]

In addition to that, a government stimulus package amounting to US$7.1 billion (Rp. 73.3 trillion) in 2009 also propped up domestic consumption. The government has continued its stimulus package with Rp. 38.3 trillion for the year 2010.

This success has pushed the Indonesian government to project very optimistic growth in the next five years. At the end of the National Summit in October 2009 which was attended by more than 1300 officials from the government, foreign chamber of commerce, bosses’ associations, etc, the Coordinating Minister of the Economy, Hatta Rajasa said that the government was targeting high average economic growth: 5.5-5.6 percent in 2010, 6.0-6.3 percent in 2011, 6.4-6.9 percent in 2012, 6.7-7.4 percent in 2013, and 7 percent in 2014.

However, this doesn’t mean that the Indonesian workers can escape the crisis. In February 2009, Rizal Ramli of the private think-tank Econit said he estimated companies had cut 800,000 jobs since the previous year.[9] Most of the lay-offs were recorded in manufacturing industries: textile, garment, automotive, shoe-making, and paper. By the end of 2008, some 250,000 migrant workers had already been sent home by their employers.[10]

The fact that Indonesia recovered quickly from the crisis is no cause for celebration for the ordinary workers and peasants. Brazil, India, Indonesia, China, and South Africa (termed the BIICS) are touted as the countries that pulled up world economic growth while the rest of the world slumped. The recent OECD report entitled Going for Growth 2010 gave a “suggestion” to the Indonesian government to phase out fuel subsidies. Pier Carlo Padoan, Deputy Secretary-General and Chief Economist at the OECD, said that halting fuel subsidies is one of the measures that has to be implemented in Indonesia: “India and Indonesia respectively spend 10% and 20% of their budget for subsidies, most of them energy subsidies. If fuel prices remain low, not only [do] we have wasteful consumption but it can also hurt the environment.”[11] This is preparation for a massive cut in public spending that is needed to balance the deficit created by bailing out the failing banks and companies during the economic recession.

In addition to that, in 2009, the government passed Law 39/2009 that promotes the establishment of Special Economic Zones to promote industries by relaxing labour and environmental regulations and providing subsidies for companies, all in the name of promoting competition in Indonesia. Since the passing of the law, there have been 48 regions that have applied for SEZs. The government is planning to build five SEZs all over Indonesia by 2012.[12]

On January 1st 2010, Indonesia, with the other nine member states of ASEAN, ratified the ASEAN-China Free Trade Agreement (ACFTA) which reduces the tariffs of over 7500 product categories, or about 90 percent of imported goods, to zero. The ACFTA is the largest free trade area in terms of population, with nearly 1.9 billion people, and third largest in terms of nominal GDP. Following the ACFTA is the ASEAN-India Free Trade Agreement (AIFTA) which was to come into effect in Indonesia by June 1st 2010 and Indonesia was committed to reducing import tariff by as much as 42.5%.

Both of these free trade agreements will flood the Indonesian market with cheap goods from China and India, destroying manufacturing industries and agriculture in Indonesia, and creating a more severe race to the bottom not only in Indonesia but the whole ASEAN-China-India region. These free trade agreements will hurt the workers and peasants of the whole region. However, the solution is not more protectionism, as free trade and protectionism under capitalism are two sides of the same coin. As a matter a fact, protectionism brings forth counter-measures of a similar kind from other countries, resulting in a sharp contraction of world trade and therefore a world slump. For underdeveloped countries such as Indonesia, protectionist measures from big capitalist countries would deprive them of export markets and thus destroy their home industries nonetheless, and thus would push million of workers and peasants out of work.

Given the current global economic situation of a stunted jobless recovery, the optimistic projection of the SBY government stands on very shaky ground. Even though formally the recession is over, the effect of the recession will be prolonged and the recovery will not be smooth. First of all, this great recession was overcome by the advanced countries by injecting as much as US$11 trillion, or 1/5 of global output, into the economy in order to save the situation. According to the IMF, the gross public debt of the ten richest countries will be 106% of overall GDP. This figure was 78% in 2007. This big deficit will have to be paid by cutting public spending, which will mean a decrease in domestic consumption in most of the advanced capitalist countries in the years to come. Furthermore, the crisis of overproduction in the advanced capitalist countries is severe, with a production capacity 30% larger than the buying power of the consumers. This will mean that the economic recovery in the advanced countries will proceed without job creation. While decreasing the import demand from Asian countries, this will also reduce foreign investment. Almost 50% of investments of non-financial companies in Indonesia comes from foreign capital. As a result, we have started witnessing many investment plans in Indonesia that have been postponed or cancelled. With the decline in foreign investment and demand, we will see a decline in the production level in Indonesia and an increase in the level of unemployment.

The New Era

The 2008/2009 financial crisis was the biggest since the 1929 Great Depression. Economically, socially, and politically, it has left a mark in the history of capitalism. The world will never be the same again. Indonesia, which is closely tied to global capitalism, cannot escape from this crisis. As the capitalists around the world are struggling to deal with the contradiction of their system, they will unload the burden of the crisis onto the backs of billions of workers and peasants.

More than 150 years ago Marx and Engels wrote in the Communist Manifesto: “And how does the bourgeoisie get over these crises? On the one hand by enforced destruction of a mass of productive forces; on the other, by the conquest of new markets, and by the more thorough exploitation of the old ones. That is to say, by paving the way for more extensive and more destructive crises, and by diminishing the means whereby crises are prevented.”

This is exactly what the capitalists around the world are doing now. Factories are being closed with millions of workers being laid off (“enforced destruction of a mass of productive forces”) and those who are still fortunate enough to keep their jobs are being forced to work harder and longer with lower pay. There is a slump in global demand and capitalists around the world are forced to seek more new markets and further expand the old ones (“conquest of new markets, and by the more thorough exploitation of the old ones”) through free trade agreements and all sort of economic schemes. However, capital has penetrated to almost all the corners of the world and there are hardly any more new markets to conquer. In the past 50 years, capitalism has managed to avert major crisis by opening up new markets (China, India, and Russia being the major ones). Consequently, this paved “the way for more extensive and more destructive crises, and by diminishing the means whereby crises are prevented.” Indeed, a bigger crisis is awaiting the ruling class worldwide.

[End]

(July, 2010)

Footnotes

[1] Kano 20.

[2] Dhanani 39.

[3]Indonesia, Biro Riset Ekonomi, Outlook Ekonomi Indonesia: Krisis Finansial Global dan Dampaknya terhadap Perekonomian Indonesia (Bank Indonesia, Januari 2009) 23.

[4] Dhanani 126.

[5] CIA World Fact Book.

[6] Indonesia, Biro Riset Ekonomi 23.

[7] The Asia Economic Monitor - July 2009, (Asian Development Bank) 5.

[8] The Asia Economic Monitor - July 2009 61.

[9] Adriana Nina Kusuma and Tyagita Silka, “Indonesia growth slips in Q4, risks job losses,” Reuters India, 16 February 2009.

[10] Dhanani 36.

[11] “RI diminta stop subsidi BBM bertahap,” Bisnis Indonesia 30 Maret 2010.

[12] “Pemerintah akan bangun 5 Kawasan Ekonomi Khusus,” tvOne [Yogyakarta] 11 Maret 2010